tax sheltered annuity taxation

2 The polite term usually given to a contrived scheme to avoid or reduce a liability to taxation. From 25000 to 34000.

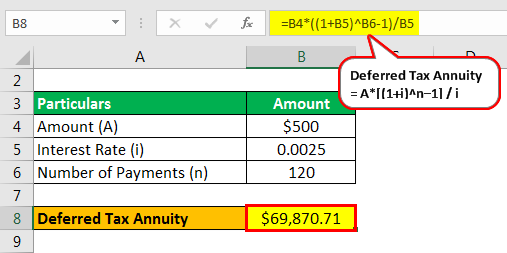

Tax Deferred Annuity Definition Formula Examples With Calculations

In other words all of the funds were sheltered from income taxes while in the account.

. Sheltered Workshop Tax Credit. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. For Tax Year January 1 2021 December 31 2021 Or Other Tax Year Beginning 2021 Ending 2022 21 21 Names and Social Security Number NJ-1040X 2021 Page 2.

RRSPs also offer an immediate benefit when it comes to your tax return. Where a country grants tax incentives to encourage foreign investment and that company is a resident of another country. Use the labels provided with the envelope and mail to.

Inherited Annuity Tax Implications. However these taxes will be determined by how you set up the annuity contract. A registered retirement savings plan RRSP French.

TAX SPARING CREDIT -- Term used to denote a special form of double taxation relief in tax treaties with developing countries. Receive guidance for placement on the conventional job market or in a sheltered workshop as a disabled person. Sometimes a TDA plan is also referred to as a voluntary savings plan a supplemental plan a tax-sheltered annuity TSA or simply a 403b plan.

The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan. But with a qualified annuity you must pay taxes on. As previously discussed annuities are tax-deferred.

It is a government tax. Régime enregistré dépargne-retraite REER or retirement savings plan RSP is a type of financial account in Canada for holding savings and investment assetsRRSPs have various tax advantages compared to investing outside of tax-preferred accounts. State of New Jersey Division of Taxation Revenue Processing Center Refunds PO Box 555 Trenton NJ 08647-0555 Tax Due Address Enclose payment along with the NJ-1040-V payment voucher and tax return.

Contact SACT Contact the SACT at the NJDPB in writing or by calling 609-292-7524. A qualified retirement plan is a qualified employee plan a qualified employee annuity or a tax-sheltered annuity plan or contract refer to Publication 575 for definitions. Income Tax Film and Digital Media Tax Credit.

It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age. Division of Taxation PO Box 281 Trenton NJ 08695-0281. The time it takes to receive money from an annuity often depends on the company you are dealing with.

SEPs and Section 403b tax-sheltered annuities or Section 1035 annuity or life insurance exchanges. For the tax year 2022-23 the main rates of income tax are as follows a the basic rate is 20 b the higher rate is 40 and c the additional rate is 45. Tax-advantaged retirement savings plan available for public education organizations some non-profit employers only Internal Revenue Code 501c3 organizations cooperative hospital service organizations and self-employed ministers in the United States.

Income Tax Film and Digital Media Tax Credit. It has tax treatment similar to a 401k plan especially after the Economic. Under the Simplified Method you figure the taxable and tax-free parts of your annuity payments by completing the Simplified Method Worksheet in the Instructions for Form.

In addition to potential surrender fees the IRS also charges a 10 early withdrawal penalty tax if the annuity-holder is under the age of 59 ½. Print and download New Jersey income tax returns instructions schedules and supplemental forms. An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings.

IRS Publication 575 Pensions and Annuity Income defines a qualified plan as one of the following. How does the tax work on that annuity. If you withdraw funds.

State Premium Tax. In the United States a 403b plan is a US. Benefits will be subject to tax if you file a federal tax return as an individual and your combined gross income from all sources is as follows.

3 Default and savings rates of income tax for tax year 2022-23 1 For the tax year 2022-23 the default rates of income tax are as follows a the default basic rate is 20. An individual retirement account is a type of individual retirement. A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met.

For more information on the tax treatment of withdrawals see Taxation of Nonperiodic Payments later. Division of Taxation PO Box 281 Trenton NJ 08695-0281. Print and download New Jersey income tax returns instructions schedules and supplemental forms.

The money you contribute to the RRSP and the investment in the plan are sheltered from taxes until you start withdrawing the money. Applying for the review of a pension annuity following an occupational accident or illness that occurred before 1 January 2011. In the United States an IRA individual retirement account is a type of retirement plan with taxation benefits defined by IRS Publication 590.

You may have to pay income. They were introduced in 1957 to promote savings for. Qualified annuities may either come from corporate-sponsored retirement plans such as Defined Benefit or Defined Contribution Plans Lump Sum distributions from such retirement plans or from such individual retirement arrangements as IRAs SEPs and Section 403b tax-sheltered annuities or Section 1035 annuity or life insurance exchanges.

A Qualified employee retirement plan including qualified cash or deferred arrangements CODAs under section 401k b A qualified annuity plan c A tax sheltered annuity plan for employees of public schools or tax-exempt organizations. A tax-sheltered annuity plan often referred to as a 403b plan or a tax-deferred annuity plan is a retirement plan for employees of public schools and certain tax-exempt organizations. Contributions made from Jan 1 st to March 1 st of the following year which is the first 60 days after the taxation year.

For purposes of this subsection the term individual account plan means any defined contribution plan including any tax-sheltered annuity plan under section 403b any simplified employee pension under section 408k any qualified salary reduction arrangement under section 408p and any eligible deferred compensation plan as defined. A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. A tax-deferred annuity can be a win.

The program consists of two separate plans. The typical timeframe for receiving cash from an annuity is four weeks. Sheltered Workshop Tax Credit.

The SACT-Regular Plan and the SACT-Tax-Sheltered Plan. A 403b plan functions similarly to a 401k plan by featuring tax-deferred. Filling in a tax return as a resident taxation by assessment.

Refund or No Tax Due Address Use the labels provided with the envelope and mail to. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance.

Annuity Lifetime Income Later Safety Taxes Magi

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

Tax Sheltered Annuity Faqs Employee Benefits

What Is A Tax Sheltered Annuity Due

The Tax Sheltered Annuity Tsa 403 B Plan

Tax Deferred Annuity Definition Formula Examples With Calculations

Withdrawing Money From An Annuity How To Avoid Penalties

How To Avoid Paying Taxes On Annuities Due

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Learn About Retirement Income And Annuity Tax H R Block

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Qualified Vs Non Qualified Annuities Taxation And Distribution

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Tax Schedule Annuities Retirement Planning

What Are Tax Sheltered Investments Types Risks Benefits

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial